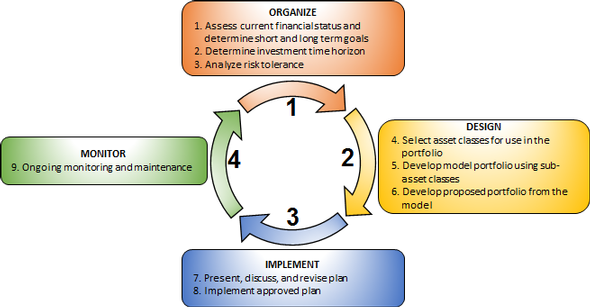

Our Process

We want you to feel confident and comfortable with your plan. Our process is designed to do just that.

This figure shows how we work with clients and the individual steps we take to ensure that we help you meet your financial goals.

Step 1: Organize

Step 1 is the initial meeting. This is a consultation in which we discuss your current situation and where you would ideally like to be. We discuss short-term and long-term financial goals, when you would like to retire, what kind of lifestyle you want to have when you are retired, college planning, etc. We also analyze your risk tolerance. Most importantly, this meeting is an opportunity to talk and get to know each other to see if we would make a good team.

Step 2: Design

The Design step is where our Firm works with the information we gathered during Step 1 to develop a plan based on your specific circumstances and goals. Using your risk tolerance and investment time frame, we will develop a model portfolio that we believe will provide an expected rate of return. The model portfolio is designed to help you reach your goals with an appropriate level of risk. We then fill the model portfolio with quality investments to create a diversified set of investments.

Step 3: Implement

The third step is where we have a second meeting to present the proposed plan and possible alternatives. Once any revisions are made and the plan is approved, we begin to implement the plan.

Step 4: Monitor

The final step in the process is to monitor your plan and portfolio, and to make any necessary reallocations. We do this throughout the year on an ongoing basis. Step 4 also includes an annual review meeting during which we discuss how the plan has performed with respect to our expectations we determined in Step 2. This meeting also serves to lead us back to Step 1, where we discuss any changes that have occurred over the past year that would impact the design of the plan and portfolio.